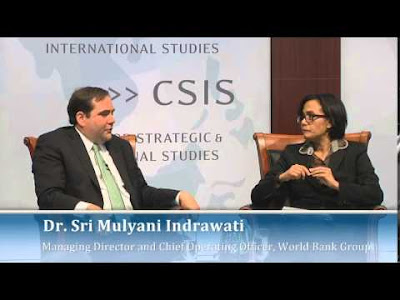

View from IMF – Interview with Sri Mulyani Indrawati, Finance Minister, Indonesia

The interview was conducted by The Banker (The Financial Times), 7-9

October 2016.

--------------------------------------------------------------------------------------------

1) So, obviously you were

appointed this year, this new appointment also followed the revision of the

2016 budget and that also involved a revision downwards of both the government

expenditures and revenues. And from [..] say that in previous months in a year

there was almost an over and optimistic view of the state finances. What would

you say to that in light also on the revision of the budget?

Well I took the job two months ago, and that means

that the Indonesian fiscally year is the same calendar year, meaning that we’ve

already finished almost six months, so we entering the August which is the

eighth month, so seventh of it, the eighth month of the year. And we see all

the revenue collection in the past three years in Indonesian budget is always

underachieved what is already targeted in the budget law. So I took

[deliberately] to look at what went wrong, what was behind all the maybe

miscalculation, and of course we can easily identify in the sense that the

commodity price, very weak export, or global trade affecting directly Indonesia

as the commodity producers so you see that the mining sector all [has been in]

negative growth, export and import [are in] negative growth. So that kind of

thing that definitely will affect the revenue side coming from mining,

commodities and the trade activity. We look at all the risk and then we

recalculate and what is the more realistic revenue that we are going to be

collected even the only five months left.

So we discuss and I look at all the underlining data

and they come with the 20.018 trillion rupiahs which is I think that is the

correction which is quite steep considering that we are only [having] five

months left. So what is gonna be then the scenario to [soft lend] this kind of

revenue short. I think we look at the spending side and we see that there is

ability to still trimming down the spending without sacrificing the priority of

building infrastructure, poverty reduction and addressing the issue of inequality

in Indonesia.

2) And where will the cuts in

public spending be in terms of the sectors, where would the change happen?

Well, basically it

is not in the sector but activity, because it is across ministerial but it will

then affect those spending which is considered not really aligned-well with the

objective of the priority for example like the trip or the convention or

meeting spending which we think that that can be still create a more efficiency

room without sacrificing. Or if it is related to some of the infrastructure

capital spending, we are deciding to lengthen the spending. So we are not

really cutting, but we are stretching. So if original project design is going

to finish by December, we can actually lengthen into additional six months. So

it will affect our budget in 2017, but it will not affect the momentum of

growth that we try to maintain in this moment.

3) So, to people who potentially

worry for some points who [..] infrastructure spending if that might be

affected it wouldn’t necessarily be cut, but maybe a lengthening or looking at

[..]

Yes, that’s what we

discuss with all what you call it the sectoral industries, the public world,

transportation, housing, all those things which agriculture especially on the infrastructure

related to irrigation, we said that they are going to be able to lengthen their

project execution so it’s not going to be affected by saying that “I am going

to cut and that’s why the project will be abandoned”.

4) In terms of boosting revenues, obviously there

has been the news of this tax amnesty program which obviously will have

potentially beneficial effects, what about [..] argue however that’s to have a

more sustainable long term boost of government revenues there needs to be a

wider reform in terms of tax in Indonesia, and especially to broaden the tax

base. What are you looking to do in that [front]?

Well,

the tax amnesty aiming to off course creating an opportunity for all the

Indonesian tax payers who in the past is not complying fully the tax. Some of

them maybe have paying tax but not fully disclosed, others maybe even [..] not

paying tax. So this tax amnesty law providing the opportunity as the rights for

them, tax payers to participate by disclosing more accurately their income,

their asset, then they are going to pay according to the timeline in this the

first three months, the [..] is 2 percent, second three months is gonna be 3

percent, and the last three months, this is the nine months program is gonna be

5 percent.

Off course with that the implication not only

just that we are aiming for capital inflow of those people who can repatriate

because if you decide not to repatriate, the rate that you have to pay is doubling

than if you are going to repatriate. So, there is an intention of repatriating

more asset or income. But most importantly it’s actually for Indonesia to have

a much more accurately [..] because people, tax payers, feel that this is the

opportunity for me, to comply, with such a very low fine, and you are going to

be freed from the administrative fine or consequence as well as the criminal

charge for the tax, only. So we are encourag[ing] all tax payers to participate

in this, in order for them to be able to then complying the tax. We are aiming

for then the new information which is more reflecting the accurate both in [..]

or wealth or asset of both individual or corporation and with that, it will

then reflect the much more solid robust accurate new database for us.

5)

And that would help in terms of on

a long term basis increase the tax payers so that would be your and objective,

really that different objective [is that]?

Definitely. Because, if you look at in Indonesia with

the tax ratio which is below 12%, and if you look at within the three months

with around 380 thousand people participating, it’s generating 7.4 billion

fine, or around almost 300 trillion asset disclosure, I think that is really

showing that a lot is actually hiding or not being disclosed truly by our tax

payer. I think that’s then require the most important part on the government,

that is; if they are going to disclose and willing to participate, can we make

sure that the tax department and our tax official is going to be able to

collect tax in a professional way, it’s not harassing, it’s not committing to

the corruption, and so on. So the issue about the tax reform is gonna be, is

now becoming very very very important for us to do. And that’s exactly now

priority. So we are planning to change the law, we are going to do many of the

reform within the director general of taxation, whether this is really the

structure, governance, the conduct, and [..]

6) It has to be a

[motivational] approach because it involves the difference [..]

Yes, it’s very important because the bottom line is

that we want not only just collecting the information but building trust. This

is the trust building between tax payer and the government in order for us to

create a new page in the life of the Indonesian people.

[Well thank you very much for joining us and good luck

with your government madam Minister, thank you very much].

Link: Click here to see the video

Link: Click here to see the video

Blackjack and Casino | Dr.CMD

ReplyDeleteThe 대구광역 출장샵 Blackjack side bet is just like a typical table game 여수 출장안마 of 문경 출장안마 a traditional casino. You are given a total 고양 출장안마 of 40 cards, and the dealer will 강릉 출장안마